Situation

Until the financial crisis, bank’s business models were often considered as robust. Particularly large and medium-sized banks aimed to reach a wide range of customer with a variety of services and products. Back then, banks were happy to accept high costs due to complex processes and IT solutions as they benefited from interest rates and a relatively low level of regulation.

However, since the financial crisis, the resulting phase of low interest rates put most banks “robust” business models into question. The increased level of regulatory requirements combined with legacy systems and cost inefficient IT solutions put another burden on banks.

Furthermore, in recent years, increased use of technology and digitalization have allowed new players to access the banking market. Start-ups and venture capital–backed companies were using developments in network technology and “big data” analysis to disrupt the way that financial services could be provided. As their products and services tend to be developed quicker, more cost-effective and in a more user-friendly way, they managed to gain market share in the banking industry.

Consequently, banks revenue sources are declining, and the already complex cost structure continue to worsen, so that their once so robust business models now prove to be fragile, inflexible and costly. Banks now need radical solutions to exit this vicious circle, innovate themselves and go back to their previous glory.

Operation of dimensions via contexts

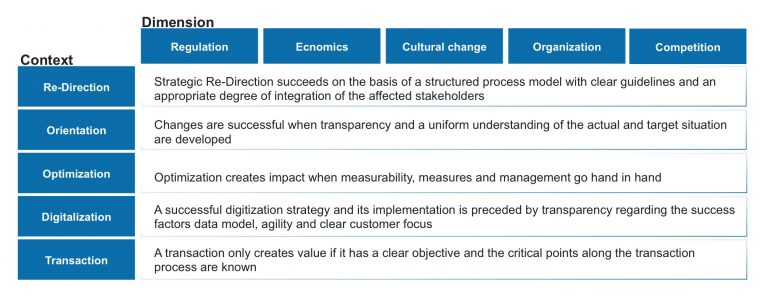

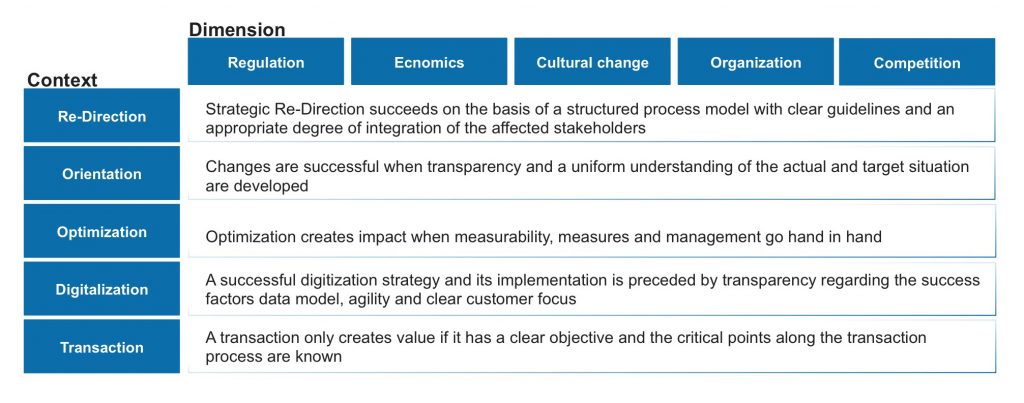

It is therefore vital for banks to clearly identify the challenges relevant to them within the five dimensions illustrated below and to derive from the multitude of possible solutions those which prove to be effective in the long term. For this reason, ConMendo is convinced that looking at challenges in isolation is not enough but needs a holistic approach, focusing on all of the five ConMendo contexts.

ConMendo approaches the challenges through a context lens (illustrated below) and develops the appropriate solution for each respective challenge:

It is therefore not excluded that an identified challenge of one dimension may not necessarily have to be met by the one solution from one context, but possibly be met by several successive solutions from one or more contexts.

The ConMendo Approach

The ConMendo approach is based on contexts. This allows a holistic approach, considering future challenges and ensuring a customer specific, tailor made solution for each problem. Clients benefit from our wide range of experience in the financial service industry as well as proven process models and a comprehensive selection of tools and frameworks.

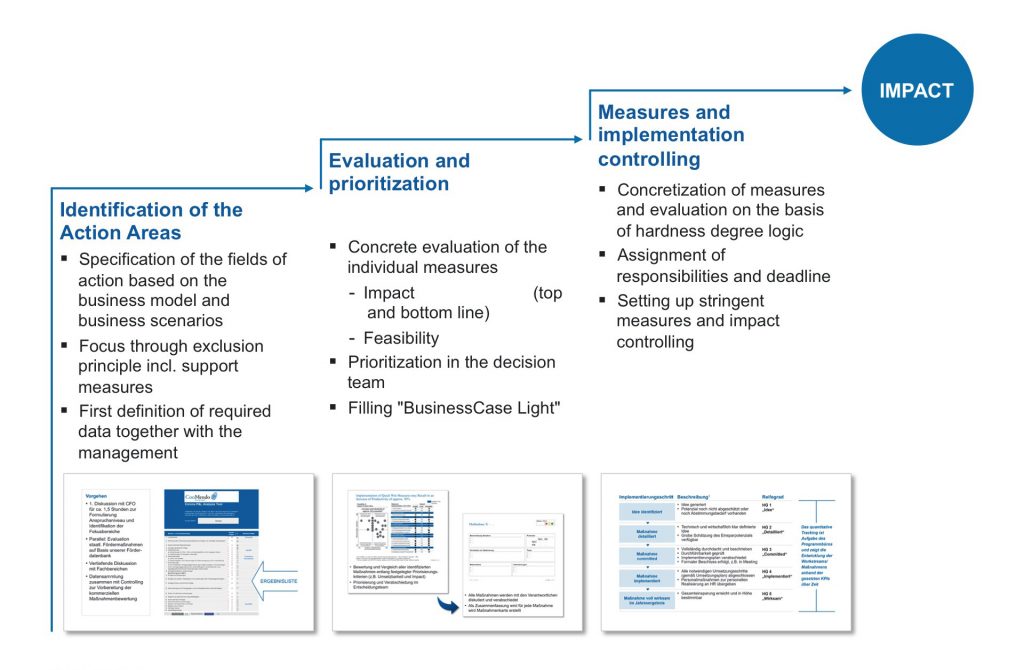

Fig. 2: Example of a multi-stage procedure for project implementation