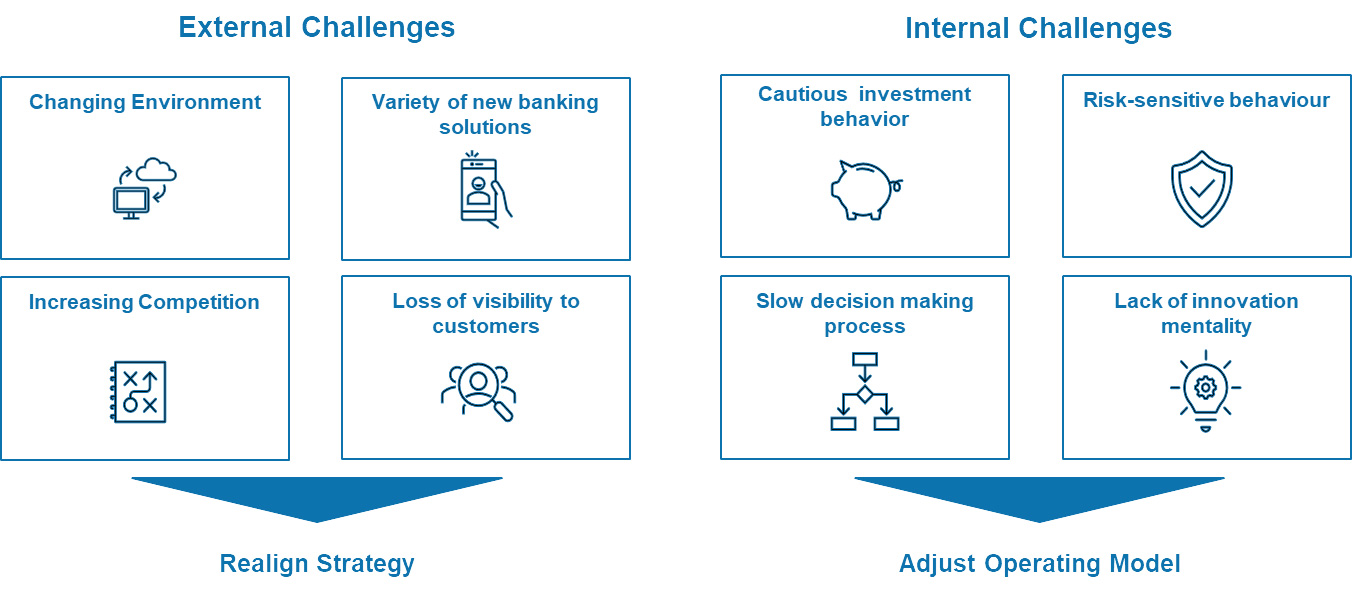

It is well known that the banking industry is dealing with major challenges. The origins are often believed to be related to the external environment of banks. Especially innovative banking technologies have changed the financial sector in recent years: Smart financing solutions and payment methods, user-friendly online banking interfaces, mobile payment solutions and cryptocurrencies have made banking more customer centric. In addition, FinTechs mix up the traditional banking industry with innovative software solutions and take on the banking sector. Customers now have a more choices and can now also engage previously traditional banking products and services from non-banking companies.

In addition to the challenges mentioned above, banks deal with many internal frictions. These include, for example, slow and lengthy decision-making processes, insufficient innovation efforts or reluctance to necessary investments into new, more modern solutions. All of them require full attention as well as a constant adjustment to the operating model to maintain the quick response time to the changing environment.

Therefore, it only seems logical, that the institutes continuously need to deal with the alignment of their corporate strategy and the adjustment of their operating model in order remain competitive.

Fig. 1: Selection of external and internal challenges

Focus of Banking

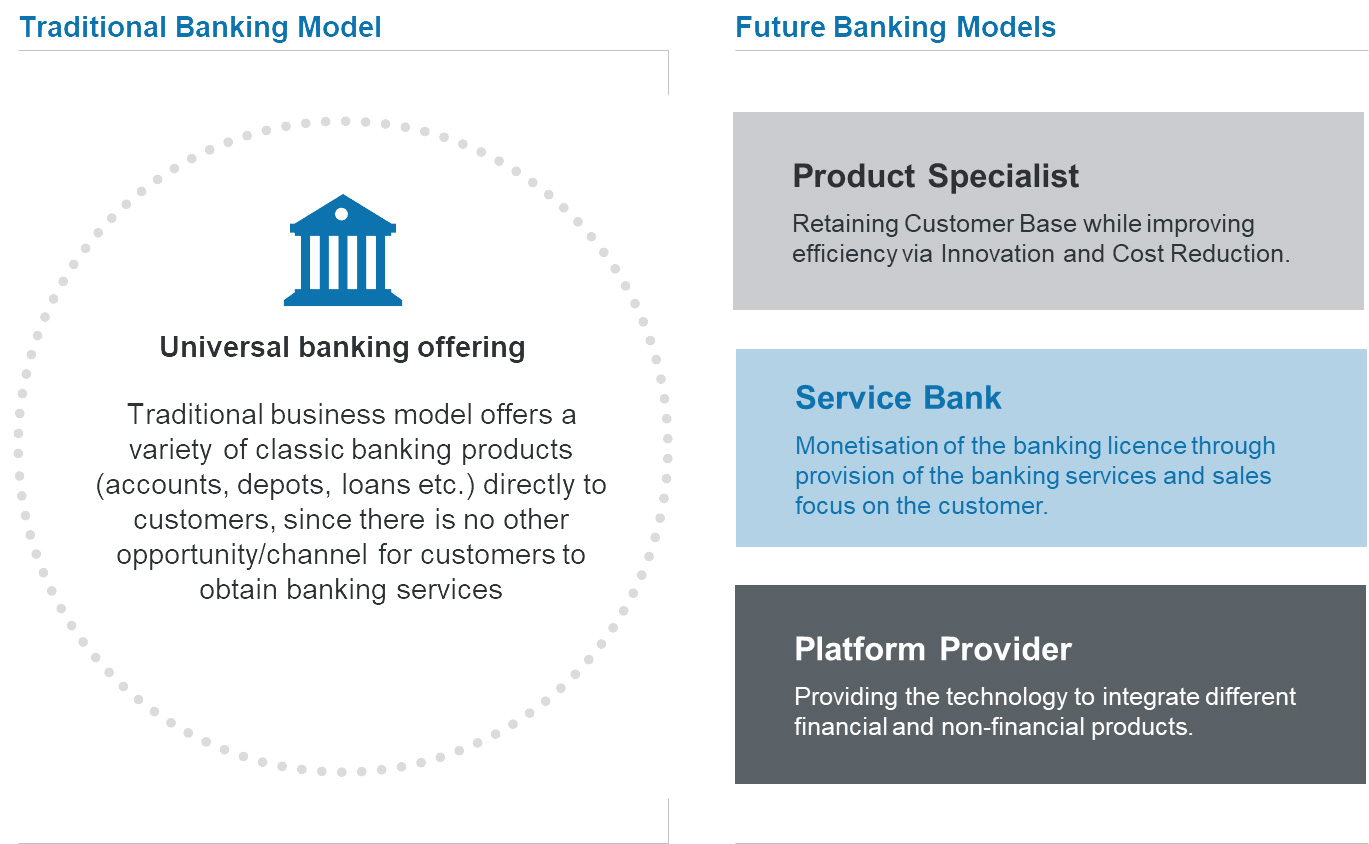

As a result of these developments, different possible future banking models for banking emerge; these are successively fragmenting and redefining (traditional) banking models – especially that of the universal banks. Today, we would like to focus on the three core strategies:

Fig. 2: Traditional vs. future Banking

The Product Specialist: the bank focuses on a smart and efficient product portfolio which can be adapted quickly to new requirements and forms only a part of the universal bank spectrum. Banks that choose this model deliberately discard products and product areas that do not contribute positively to their core business model. The specialized Products and services will then be also offered to third parties as white label solutions.

The Service Bank: here, the institute is a service provider for customers and focuses particularly on their customer needs. Understanding their customers’ needs and ensuring customer proximity are the key focus of this model. Sales performance is essential and IT solutions are bought.

The Platform Provider: bank choosing this model focus is on technical efficiency and excellence. They focus is on B2B clientele and enable them with intelligent banking solutions, which are also available and enables third parties to provide modern and smart banking solutions.

ConMendo-Approach

It is crucial for banks to decide to what extent and how fast they want to (or can) implement their chosen strategy. ConMendo has developed a three-stage approach which first assesses the transformation status and then helps to ensure a successful implementation. Assuming that the decision regarding the strategic orientation has been taken, we support you in the following way:

- Maturity assessment

First, it is important to determine the current transformation status towards the target state. The Maturity assessment will contribute to the transparency while guiding through following questions:

- Is there a consistent level of transparency and acceptance regarding the desired target image?

- To what extent is the operating model aligned with the chosen strategy?

- Are there recognizable obstacles and successes factors? How is the speed of implementation measured?

- Alignment of the transformation process

Based on the previously discussed maturity assessment and based on following questions, we develop a client specific action plan to ensure a successful implementation completion:

- Which measures are crucial for the successful completion of the transformation?

- What are additional measures that should be considered to ensure a successful change process (e.g., behavioural change, empowerment)?

- How will measures be evaluated to successfully identify and prioritize the best implementation measures?

- Implementation and Performance Measurement

The defined measures now get consequently implemented in collaboration between the client and ConMendo:

- Ongoing measurement of success and presentation of implementation status based on KPI catalogue

- Ongoing measurement of satisfaction in the affected areas

- Short-term adjustment of measures in response to possible irritations

Do you share our approach of re- directing the future of banking? What status are you in? Are you feeling curious to learn more? Would you like discus this topic with us? We are looking forward to hearing from you.